Advertising Law Insights From Madison Avenue and Beyond

Spring 2023 | Issue 10

Letter From the Editor

The warmer weather and spring blooms aren't the only cause for celebration. We are also celebrating our 10th issue of Kattison Avenue. In this issue, we take a look at a wide range of advertising issues involving intellectual property, digital assets, generative AI and advertising regulation. We start this issue with a piece from partner Michael Justus, who discusses the implications of registering trademarks for digital assets such as non-fungible tokens (NFTs) and virtual goods. He emphasizes the importance of having a genuine intention to use the trademark in commerce. I follow Mike with a timely piece on the latest in Bored Ape Yacht Club's battle against copycats, including a recent decision siding with BAYC's parent on claims of false designation of origin and cybersquatting. And even though we're also wary of yet another ChatGPT story, there's no denying that generative AI is creating a frenzy of activity in creative and intellectual property circles. Here London senior associate Sarah Simpson and associate Tegan Miller-McCormack provide an overview of how the UK is responding to issues raised by ChatGPT. Partner Chris Cole then shares an update about how the National Advertising Division is now accepting "implied" claims in "short-form" advertising, such as social media posts. Chris offers practical guidance for advertisers on how to avoid misleading consumers. Finally, Sarah, Tegan and Chris examine the intersection of fashion, advertising and ESG, addressing challenges faced by fashion brands when it comes to sustainability claims. Thank you for reading and don't hesitate to reach out with questions about the latest developments in advertising law.

Jessica G. Kraver

Do You Really Intend to Offer NFTs, Digital Collectibles and Virtual Goods? If Not, No Trademark

The NFT explosion has led to a "gold rush" of thousands of new US trademark applications covering NFT-based digital files, digital collectibles and the like.

There are offensive and defensive motivations for brand owners to join in the NFT trademark frenzy. Offensively, they may see NFTs as a legitimate business opportunity for which they have concrete plans to capitalize. Defensively, brand owners may be concerned about preventing unscrupulous third parties from using or registering brands without authorization. But are the owners of those trademark applications actually using the marks for those items, or have a bona fide intent to do so? If not, the trademark filings may not be worth the paper they're written on.

At the time of filing a US trademark application, you must either: (a) already be using the mark in US commerce for the listed goods and services or (b) possess a bona fide intent to use the mark for such products or services. Absent use or intent to use, the application is void. 15 U.S.C. § 1051; Swiss Grill Ltd. v. Wolf Steel Ltd., 115 USPQ2d 2001, 2008-09 (TTAB 2015) (application void for lack of bona fide intent to use).

Third parties can challenge trademark applications or registrations for lack of use or lack of bona fide intent. In such challenges, the Trademark Trial and Appeal Board (TTAB) will look for objective evidence of use or a firm and demonstrable intent to use the mark for the covered products or services. Some TTAB cases have required documentary evidence of plans to use the mark (i.e., a big idea in one's head may not count). See, e.g., Swiss Grill Ltd., 115 USPQ2d at 2008-09. Certainly, a purely "defensive" trademark application — with no use or intent to use, but rather only the intent to block third parties from registering the mark — is insufficient under US law. Likewise, a purely opportunistic trademark application to "plant a flag" in case the applicant may someday decide to offer the listed products or services — absent bona fide intent to use — is insufficient.

Given the intense "gold rush" of NFT trademark filings and the unique challenges of actually entering the NFT ecosystem, it seems likely that use and intent-to-use challenges will follow. At the time of writing, we did not locate any reported TTAB decisions addressing lack of use or intent to use for trademark applications covering NFT products and services. But that is likely to change — and soon.

For more content on NFTs, check out this recent article on NFTs and the Enduring Allure of Digital Collectibles.

This article first appeared April 20, on katten.com as part

of a special NFT Thought Leadership Series.

Bored Ape Yacht Club NFT Drama Isn't Boring At All

NFTs are a new medium that embodies traditional forms of intellectual property, including trademarks and copyrights. NFT creators can be simultaneously accused of infringing both trademark and copyright rights. In 2021, Yuga Labs, Inc. (Yuga Labs) launched a collection of NFTs featuring graphic images of apes — known as the Bored Ape Yacht Club (BAYC). The collection garnered over $2 billion in sales, finding fans among high-profile celebrities and prominent consumer brands. Part of what makes the Bored Ape NFTs so coveted is their rarity. There are only 10,000 unique Bored Ape NFTs in existence.

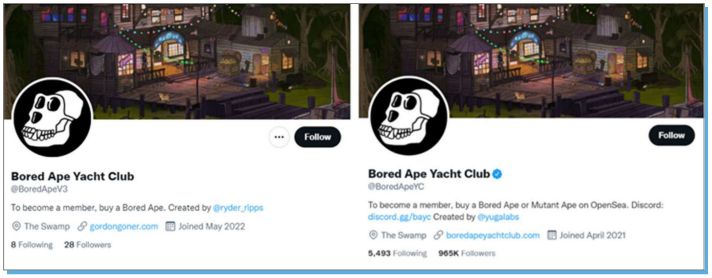

In June 2022, Yuga Labs filed suit against "conceptual artists" Ryder Ripps and Jeremy Cahen, alleging that their knock-off NFT collection — the "RR/BAYC" NFTs — infringed Yuga Labs' trademark rights in its BORED APE YACHT CLUB, BAYC and BORED APE marks, as well as other logo marks. See Yuga Labs, Inc. v. Ripps, et al., C.D. Cal., No. 2:22-cv-04355. Interestingly, when filing the complaint, Yuga Labs asserted a claim for, among other things, common law trademark infringement (as opposed to a federal infringement claim under the Lanham Act). Fast forward, and the relationship between Yuga Labs and the defendants has become so acrimonious that Jeremy Cahen recently opposed 10 different Yuga Labs trademark applications for BORED APE YACHT CLUB, BAYC, BA YC, BA YC BORED APE YACHT CLUB and the Yuga Labs logo before the US Patent and Trademark Office Trademark Trial and Appeal Board (TTAB). See TTAB Oppn. No. 91283323. Cahen argued that, under the Yuga Labs Terms and Conditions, Yuga Labs relinquished its rights to the trademarks by providing purchasers of the Bored Ape NFTs "all rights" associated with the applicable NFT, which, claimed Cahen, includes any trademark rights therein that Yuga Labs may have. Cahen also alleged, among other things, that Yuga Labs did not have a bona fide intent to use the applied-for marks in commerce when filing the applications because the Bored Ape NFTs should be classified as securities under applicable federal securities laws.

On March 21, Yuga Labs filed a motion to suspend the opposition proceeding pending the outcome of the civil litigation between Yuga Labs, Cahen and Ripps described above. The TTAB granted the motion on April 20.

As the civil litigation between the parties progressed last year, the defendants filed an answer and asserted various counterclaims against Yuga Labs last December. The second counterclaim sought a declaratory judgment that Yuga Labs is not entitled to copyright protection in the BAYC ape images because each image is "of an anthropomorphized ape cartoon that includes certain traits that are programmatically assembled with a computer algorithm." The defendants contend that there are no copyrights in the BAYC images "to the extent that they were not created by a human."

While the Central District of California denied the artists' counterclaim for a declaratory judgment of no copyright on March 17, the counterclaim does raise the timely hot topic of copyright protection in generative artificial intelligence (AI).

improper takedown notices under the Digital Millennium Copyright Act. In granting Yuga Labs summary judgment on its claim for false designation of origin under the Lanham Act, the Court issued a significant finding, relying on the recent decision in Hermes International v. Rothschild, 590 F.Supp. 3d 647, 655 (S.D.N.Y. 2022). Importantly, the Court concluded that "although NFTs are virtual goods, they are, in fact, goods for purposes of the Lanham Act," thereby rejecting the defendants' position that NFTs should be treated as unregistered securities. The Court also determined that, despite the defendants' argument that Yuga Labs transferred "all rights" to purchasers of the Bored Ape NFTs under the Yuga Labs Terms and Conditions, Yuga only grants each BAYC NFT holder a copyright license, not a trademark license.

Under a different set of facts, if the imagery underlying the BAYC NFTs had unquestionably been generated exclusively by AI tools, the case could have presented a unique opportunity for a ruling on this landmark issue.

On April 21, the Court granted Yuga Labs' motion for summary judgment on its causes of action for false designation of origin and cybersquatting. The court also awarded Yuga Labs summary judgment on the defendants' sole surviving counterclaim alleging that Yuga Labs knowingly and materially misrepresented that the RR/BAYC NFTs infringed Yuga Labs' copyright by filing In light of the fact that the Central District of California held that Yuga Labs owns the various trademarks that are the subject of the pending opposition before the TTAB, and that those marks are valid and protectable, it is likely that Cahen's opposition will likewise fail. We will be watching this case closely to see if the defendants appeal the summary judgment decision, as well as the determination of damages to be calculated at trial.

This article is part of a Katten NFT Thought Leadership series on katten.com.

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.